We live in fascinating circumstances…

You can’t switch on the TV or read a daily paper without becoming aware of fate and despair. In the event that it’s not property and securities exchange falls it’s oil costs experiencing the $100 level, and the circumstance in Iraq is by all accounts breaking down.

Indeed, we will avoid the greater part of that, with the exception of the issue of business sectors over the world going down. Now we have a craving for saying please take a full breath everyone.

It’s positively genuine that the ‘sub prime’ emergency has severely influenced the trust in the business sectors. Similarly as has the Northern Rock disaster in the UK and the Bear Stearns fall in the US. Are there any more ‘nasties’ around the bend individuals will appropriately inquire?

The appropriate response is yes there could be, and things may take a few more months for any leftover issues to show up.

So what has happened?

Indeed, more or less, it’s mostly down to avarice.

Over the most recent couple of years many banks have formulated complex items to offer on at a benefit, with the full implications of what they were offering not known at the time.

They bundled different sorts of obligation together – great, normal and low quality – and sold it on. The banks valued these bundles with a formulae contrived without anyone else’s input.

Also Read: What is stock market and how stock market works?

With the advantage of knowledge of the past, it could be contended that they failed to understand the situation in dynamite style.

Generally, the high hazard obligation wound up noticeably useless, the mid-range review obligation split in esteem, and even the astounding diminished in an incentive by around 30%. This was aggravated obviously in light of the fact that in constrained deals you have a tendency to get less.

There is likewise the issue of how banks loan to each other, called the Interbank rate, so they have the cash to loan to individuals like us.

Gone are the days (however returning?) when the bank utilized simply savers’ cash to then loan. So when certainty is hit, and banks are hesitant to loan to each other, and any loaning they do they charge significantly more for.

What we need obviously is a time of solidness, with awful obligation being composed off, and Interbank rates settling down. Working capital should be found, with well off organizations called Sovereign assets helping – at a cost.

As a foundation to this, it must be said that the most recent 15 years have been very stunning with low financing costs and high development. This ‘Goldilocks’ period is finishing, with development down and swelling up. This infers the feared word stagflation, and this is maybe more awful than subsidence.

Also Read: How to Trade in Share Market? – Share Marketing Tips

Another point is that contrasted with different times of securities exchange instability the fall in the business sectors has not looked gigantic. Contrasted with the finish of 2007 the FTSE is down around 14% and obviously may fall further or recoup. In any case, in 1974 the market fell 51%, preceding bobbing in 1975!

So what should financial specialists do?

Indeed, in the event that you needn’t bother with your contributed capital now (or inside 1-3 years) our recommendation is to hold tight. Try not to transform paper misfortunes into genuine misfortunes by offering low. We have seen new customers disclose to us that they have sold when the business sectors went down, and purchased again when they went up.

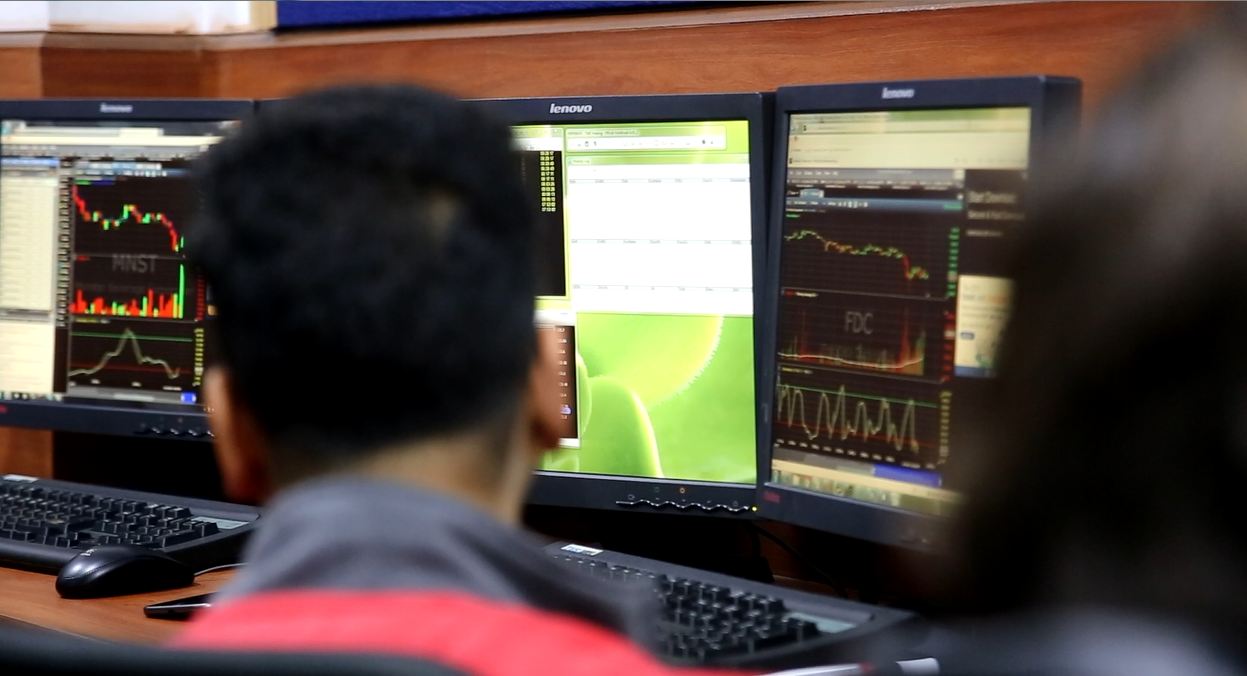

Best stock market courses in Agra, Share market training institute in Agra, stock trading courses, trading courses, stock market training in Agra, learn stock market, learning the stock market, share trading courses, stock market for beginners, online trading courses, share market courses, share market training, stock market classes, learn share market, share market courses in Agra, , learn online stock trading for, beginners, how to learn how to invest in stock market, how to learn investing in stock market, classes of stock, training trading.

ICFM is one of the best stock market institutes providing technical analysis course, option trading course strategies, share market diploma and certification.

Register Now :: https://goo.gl/UnOx6m

Email :: info@icfmindia.com

Contact Number :: 09971900635