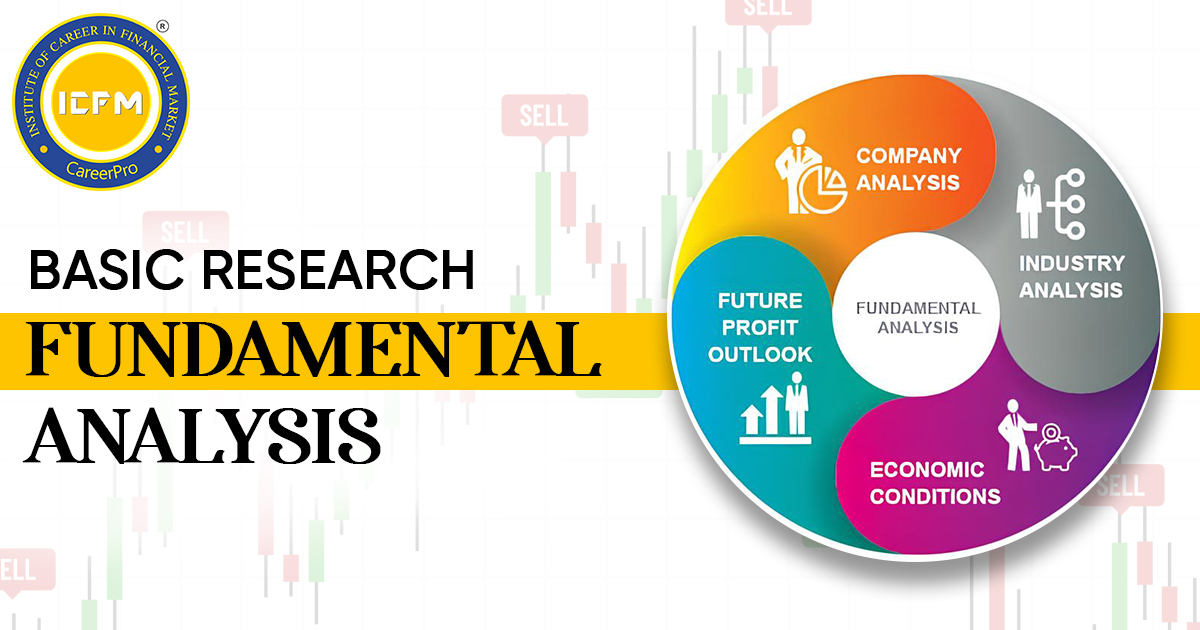

Introduction to Basic Research Fundamental analysis

It the primary method used by traders to determine the intrinsic values of securities by examining relevant economic, financial, and qualitative factors. Unlike technical analysis, which focuses on historical price movements, fundamental analysis look for underlying factors that can affect future price movements of stocks or assets.

Key features of primary research Analysis of Financial Statements

An important aspect of basic analysis is the examination of a company’s financial statements. This information includes income statements, balance sheets, and statements of cash flows. By scrutinizing these documents, companies can determine important financial metrics such as revenues, profit margins, debt levels and cash flows

Economic Analysis

In addition to financial reporting, basic analysis includes scrutiny of financial products. This includes monitoring macroeconomic indicators such as GDP growth rates, inflation, interest rates and employment data. These indicators provide insight into the overall health of the economy and how it can affect specific industries or companies.

Industry and market research

Understanding the dynamics of the industries in which a firm operates is important for fundamental research. Factors such as market structure, competitive environment, regulatory environment, and technological developments all play an important role in a company’s future prospects Analysis of these factors helps businesses measure a company’s growth potential and competitive position in its business.

Management and corporate governance

The management and corporate governance best practices can have a significant impact on the long-term performance of a company. Primary analysts examine factors such as effective leadership, strategic decision-making, corporate transparency, and compliance with regulatory standards, among others.

Basic research methods

Qualitative research

Qualitative research involves evaluating non-financial aspects of a company such as brand strength, customer loyalty, corporate culture, and innovation capabilities These innovation factors provide insight into intangible assets they do not have access that can contribute to a company’s competitive advantage and long-term sustainability.

Quantitative analysis

Quantitative analysis focuses on statistical data and financial metrics derived from financial statements and financial indicators. Analysts use quantitative methods to calculate analytical metrics such as price-to-earnings (P/E) ratios, earnings per share (EPS), return on equity (ROE), and performance of other key indicators (KPIs) These measures of different businesses in the same industry help in comparing financial health and valuation.

Fundamental Analysis for Business Applications

Stock Valuation Methods

Basic research helps traders determine the true value of a stock relative to its current market price. Common valuation methods include discounted cash flow analysis (DCF) analysis, company comparative analysis (CCA), and discounted dividend modeling (DDM). These techniques allow analysts to determine whether a stock is undervalued, overvalued, or undervalued based on its fund