Selling an Option

Option selling involves preparation of options contracts wherein there is the collection of a premium from an options buyer. As sellers, we would have to deliver the goods should it be the choice of the buyer. Selling options can thus generate an income to whoever is selling them in the form of premiums one gets from the buyer. This is very risky since the potential losses depend on the movement of the underlying asset, which maybe greatly underestimated.

Types of Option Selling :-

Selling a Call Option:

· Definition: Selling a call option means we are selling the right to the buyer to purchase the underlying asset from you at a pre-defined strike price before the expiration of the option.

Selling a Put Option:

· Definition: A seller of an option sells the right to a buyer to sell the underlie the asset to us at a predetermined strike price before the date of expiration of the option.

Motivations for Selling Options:

· Earn Premium Income: One of the most important motives for the selling of options is to generate premium income. It is the amount that the buyer pays to buy that option. It is an indication of the maximum profit that one could make with the sale of that option.

· Market Outlook: The sellers anticipate the market to continue being neutral, or to make a move in the direction that will render the option they have sold worthless. Example: A trader sells a call option, expecting the price of the underlying asset to remain below the strike price.

· Time Decay (Theta): The nearer an option gets to its expiration date, the less value contained in it due to time decay. This is good for the seller because with time, the option premium shrinks and diminishes the chances of the option being exercised.

Risks of Selling Options:

· Unlimited Potential for Loss: The writing of a call without taking an underlying position, or simply called a naked call. If the price of the asset rises substantially above the strike price, then our potential losses would be unlimited. Similarly, the sale of a naked put option results in substantial losses if the price of the asset falls significantly below the strike price.

· Margin Requirements: Selling options involve keeping margin in your trading account. If the market moves adversely against our position, one is likely to face a margin call and find oneself needing to add more funds to keep up with our position.

· Contractual obligation: Apart from the fact that buyers do have an option to exercise or not, in case the buyer does exercise it, a seller is obliged to perform the contract. This may be forced trades at unprofitable prices.

Options Selling Strategies:

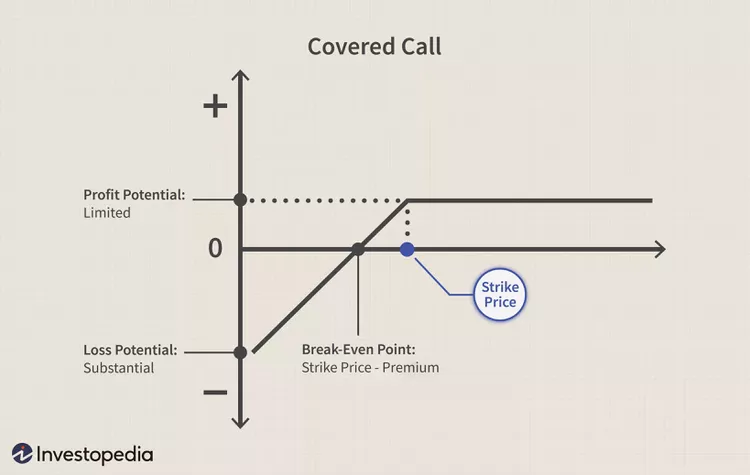

Covered Call:

· Definition: A classic example of a covered call would be selling of a call option when one possesses the underlying asset. This is way less riskier a strategy because we already own the asset, which can be delivered if the option gets exercised.

· Example: Assume we have 100 shares of TCS presently valued at ₹ 3,500 stock. We have sold an option call that expires one month from the date of the sale, with a strike price of ₹ 3,600 at a premium of ₹ 50 a share. If TCS stays below ₹ 3,600, the option expires worthless, and we pocket the premium. If TCS crosses ₹ 3,600, we have to sell our shares at ₹ 3,600 but book profit by way of premium received and profit up to ₹ 3,600.

Cash-Secured Put:

· Definition: In this strategy, one underlying sells the put option and at the same time keeps enough cash in his account to buy the underlying asset in case the option is exercised.

· Example: We reckon we've sold one put option of Reliance Industries with a strike price ₹2,400 and the current market price is ₹2,450;

we get a premium of ₹30 per share. Now if in a downside movement, the price breaks below the level of ₹2,400, then we are obliged to buy the share at ₹2,400, but since we have already gotten the premium, our net buying price will be ₹ 2,370. Suppose, if the price stays above ₹2,400, the option expires as Waive off and the premium pocketed.

Naked Call/Put Selling:

· Definition: An option call or Put is sold without taking ownership of the respective underlying asset. This is otherwise referred to as naked selling of call or put, which is highly speculative and exposes one to colossal risks simply because we do not have the asset or reserved cash to cover the contract.

· Example: Naked call of Infosys @ 1,700 Strike and stock shoots up to 1,800. We stand a chance of incurring heavy losses since you will have to buy the stock at the market price and sell at the lower strike price.

Examples of Selling Options in India:

Writing a Call Option - Example 1

Scenario: We think that the Nifty 50 index, which is at an 18,000 level, will not cross 18,200 in the coming month.

Action: We sell the call option with a strike price of 18,200, which has one month expiry and gives us a premium of ₹100 per lot. Here, 1 lot = 75 units.

Outcome 1: If Nifty stays below 18,200, this option will expire worthless, and we can keep ₹7,500 as profit through premium received.

Outcome 2: In case Nifty rose above 18,200, say to 18,400, we are liable to pay a difference between the strike price and the market price times the lot size, reducing to a loss of ₹15,000® 200 × 75), which reduced by the premium we received of ₹7,500.

Selling a Put Option:

· Scenario: We believe HDFC Bank stock, which is ₹ 1,600 today, is not going to go below ₹ 1,550 over the coming month.

· Action: Sell a one-month out-of-the-money put option with a strike price of ₹ 1,550 and earn a premium of ₹ 20 per share.

Outcome 1: In this case, HDFC Bank stays above ₹1,550, option will expire worthless and we keep the ₹20 per share premium.

Outcome 2: If the price of HDFC Bank breaks down below ₹1,500, we shall be obliged to buy it at ₹1,550 and incur a loss of ₹30 per share or ₹1,550 - ₹1,500. Deduct this ₹30 with the premium of ₹20 that we shall receive. That puts your net loss per share at ₹10.

Regulatory Framework in India:

SEBI Guidelines: Indian derivatives market is well developed on sound wickets, with regulations by the Securities and Exchange Board of India along with margin requirements, position limits, and other measures to control risks. As a matter of fact, the guidelines protect the speculative interest of an individual trader and at the same time protect the integrity of the market as a whole.

- Exchange-Traded Options: Options traded in India are listed on efficient, well-regulated exchanges such as the NSE and BSE. Thus, the trading of options is very transparent and removes the counterparty risk of a transaction.

- Tax Implications: Premiums collected from option sales represent business income. Thus, they fall within the ambit of taxation under the Indian income tax laws. Maintaining proper books and records related to this transaction are very crucial as regards their correct reporting in the tax matters.

Conclusion:

The option sell strategy, in the present market scenario of stable conditions, is one of the most efficient techniques to generate yield income in India. This is a highly risky proposition in which losses can be unlimited. Most traders take recourse to various strategies involved with regard to covered calls and cash-secured puts in order to offset the risks of option selling. To indulge in this practice, a person has to learn about the fine nuances of selling options along with the risks involved and the regulatory framework.