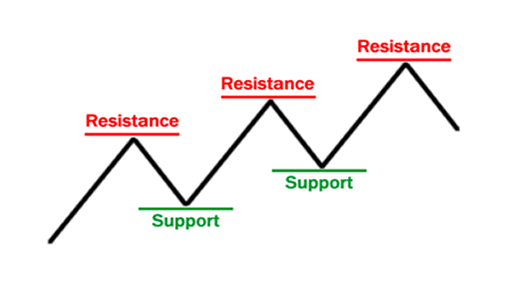

Support and resistance

Any one who is making trading decisions on the basis of technical analysis . Must know about the concept of support and resistance .These concepts help traders make informed decisions about where to enter or exit trades. Here’s a breakdown of these key principles in simple, actionable pointers:

What exactly support and resistance is :

Support - Support also known as floor is zone on price where downtrend is expected to pause and price to reverse to the upside due to concentration of demand at this particular price level .

Resistance - Resistance also known as ceiling is zone on price . where uptrend is expected to pause and price to reverse to the downside . Due to concentration of supply at this particular price level . Or price struggles to break this level to upside

Identifying Support Levels:

Past price movements - Look for the zone at which the price acted in the same way . like bounce from the same zone to the upside or fall from the same zone to the downside . The zone from which price bounced to upside will be called support zone and the zone from which price fall will be called resistance zone

Round psychological numbers - Traders often use round numbers (like 1000 , 2000) as support and resistance levels. These psychological barriers can be significant because traders tend to place buy or sell orders around these numbers, affecting price movements.

The Role of Support and Resistance in Trading Strategies:

Breakouts - When the price breaks through a resistance level, it’s often seen as a bullish signal, indicating that the asset may continue to rise. Conversely, when the price breaks below a support level, it may signal a bearish trend. Traders use these breakouts to enter trades with the expectation that the trend will continue.

Reversals - Support and resistance levels are also used to identify potential reversal points. For instance, if the price approaches a strong resistance level and fails to break through, it may reverse and head lower. Similarly, if the price approaches a strong support level and fails to maintain it, it might reverse and move higher.

Trend Confirmation - Support and resistance levels can help confirm trends. In an uptrend, pullbacks to previous resistance levels (now acting as support) can be buying opportunities. In a downtrend, rallies to previous support levels (now acting as resistance) can be selling opportunities.

Tips for Using Support and Resistance Effectively:

Consider Multiple Timeframes: Check support and resistance levels across different timeframes to get a broader perspective. A level that’s significant on a daily chart might also be important on a weekly chart.

Adjust for Market Conditions: Be aware that support and resistance levels can shift based on market conditions and economic news. Adjust your levels as new information becomes available.

Conclusion :

Support and Resistance - are vital concepts that can provide clarity in a trader’s decision-making process. By understanding these levels and how they interact with price movements, traders can better anticipate market behavior and make more informed trading decisions. Whether you’re a seasoned trader or just starting, mastering support and resistance can significantly enhance your trading strategy and overall market understanding.