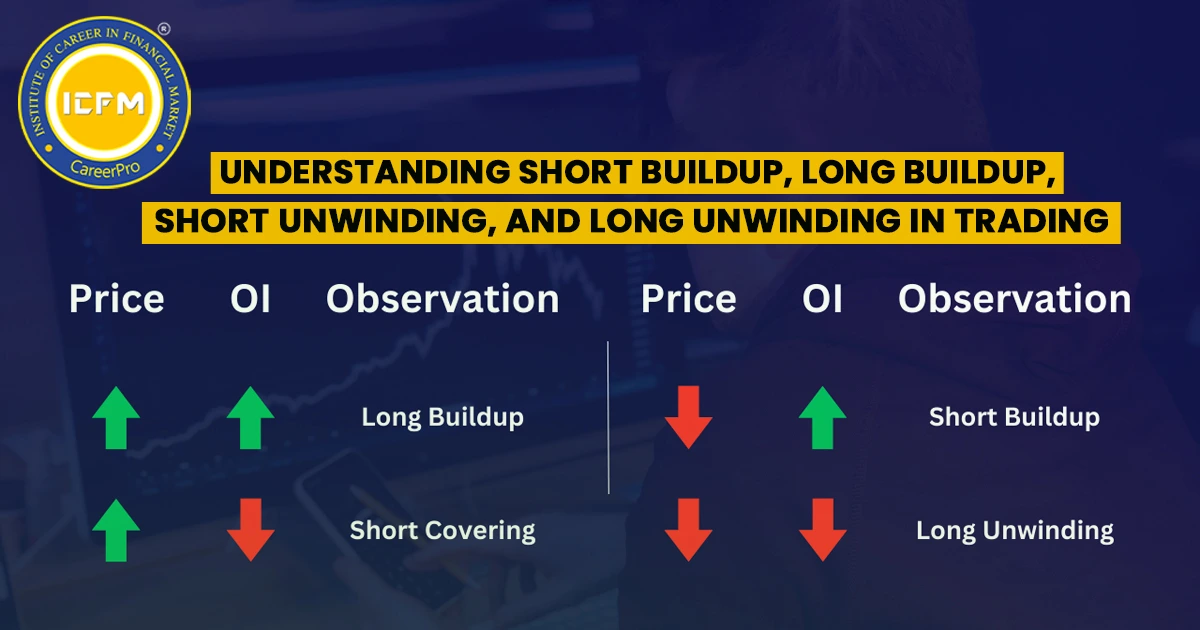

The terms used to describe market activity changes regarding traders' positions, based on trends and sentiments within financial markets include short buildup, long buildup, short unwinding, and long unwinding. Knowing these terminologies is key to understanding how markets are functioning and making smart decisions in terms of trading. The blog has provided great detail on how such concepts should be understood to show their meaning and use.

1. What Is a Short Buildup?

A short buildup is when traders increase their short positions, expecting the price of an asset to fall. In technical terms, this means that there is an increase in open interest (OI) accompanied by a decline in the asset's price.

Key Characteristics:

•Rising Open Interest (OI): This indicates an increase in the number of outstanding contracts.

•Falling Price: This reflects bearish sentiment in the market.

•Trader Expectation: Traders expect the price to continue falling and take short positions to make money from the downside.

Example:

Assume the price of Stock A drops from ₹1,000 to ₹800, while OI rises at the same time. This is a sign of short building up because more traders are anticipating the price to continue dropping.

Implications:

- A short buildup usually indicates bearish momentum.

- This could be a sign that traders are preparing for a continuation of the downtrend.

2. What Is a Long Buildup?

The long buildup is the accumulation of long positions by participants, with the expectation that the price of an asset will increase. It is marked by a rise in open interest (OI) and an increase in the asset's price.

Key Features

•Growing Open Interest (OI): It signifies greater participation levels.

•Increasing Price: Positive sentiment.

•Trader Expectation: The participants expect the price to increase; thus, the longs try to take advantage of the situation by going long.

If the price of Stock B rises from ₹500 to ₹600 and OI increases simultaneously, then it is a long buildup and indicates that traders expect the price to rise even more.

Implications:

- A long buildup indicates that the momentum is bullish.

- This may indicate that the asset price is going to move upward.

3. What Is Short Unwinding?

Short unwinding occurs when traders start closing their short positions, typically due to a reversal in market sentiment. This leads to a decrease in open interest (OI) and an increase in the asset’s price.

Key Characteristics:

• Declining Open Interest (OI): Indicates traders are closing their short positions.

• Rising Price: Suggests a shift from bearish to bullish sentiment.

• Trader Action: Traders cover their short positions to avoid losses as prices start to rise.

Example:

If the price of Stock C moves up from ₹100 to ₹120, and OI goes down, this is a sign of short unwinding, as traders are closing their bearish bets.

Implications:

- Short unwinding is a bullish sign.

- It often precedes a reversal or continuation of upward momentum.

4. What Is Long Unwinding?

It is a long unwinding when investors begin to liquidate their longs, expecting the price to turn around or reverse. It's characterized by decreasing open interest in tandem with a downward trend in the asset's price.

Key Characteristics:

- Declining Open Interest (OI): Traders close their long positions.

- Price Falling: A bearish mood.

- Trader Action: Sellers of long positions to lock in profits or prevent further losses.

Example:

If Stock D’s price falls from ₹1000 to ₹850, and OI also decreases, it signals long unwinding as traders reduce their bullish bets.

Implications:

- Long unwinding is a bearish signal.

- It may indicate the end of a bullish trend or the start of a corrective phase.

5. How to Analyze These Trends?

Tools and Indicators:

1. Open Interest (OI): A crucial metric to monitor trader activity and sentiment.

2. Price Action: Check how price patterns behave by comparing the trend with the variations in OI to identify build-ups and unwindings.

3. Volume: Volume increases help add strength to the trend witnessed

4. Technical Analysis: Tools like RSI and MACD can confirm support and resistance levels with trend momentum.

Practical Usage:

- Short Buildup- Sell Futures/ Buy Put Options

- Long Build-up - Buy futures/call options

- Short Unwind- Enter bull trades, and find reversal trades.

- Long Unwinding: Anticipate corrections and consider bearish positions.

6. Conclusion

Understanding short buildups, long buildups, short unwinding, and long unwinding is crucial to understanding market dynamics and planning successful trading strategies. Analysis of open interest, price action, and volume can prove highly informative of the market sentiment and momentum for the trader.

Whether you are a beginner or an experienced trader, keeping an eye on these trends can significantly enhance your decision-making process. Remember, combining these observations with technical and fundamental analysis will yield the best results.