Vertical Spreads in Options Trading

This has to be one of the most popular strategies among options traders, which, by and large, will bring with it a balanced bit of risk and reward to the trader. A vertical spread is a strategy by which a trader buys and sells two options of the same type-example, calls or puts-that have the same expiry date but differ in their strike prices. The strategy itself is quite straightforward and is one implemented by traders to achieve directional profit in the underlying asset while at the same time allowing control over risk by limiting both potential losses and profits.

This report will briefly describe vertical spreads in greater detail along with talking about their structure, types, and usage in practice.

What is a Vertical Spread?

A vertical spread is described as an options two-legged strategy wherein one option is bought and another of the very same type is sold; they share the same date but possess different strike prices. It is the difference in strike prices that defines the profit potential and the risk of the spread.

There are Two major kinds of Vertical Spreads:

1. Bull Spread: This is a strategy where a trader feels that the price of an underlying asset rises.

2. Bear Spread: This is a strategy where a trader feels that the price of the underlying asset falls.

Each of these can be executed with calls or put options, therefore, resulting in four major vertical spread strategies as discussed below:

• Bull Call Spread

• Bear Call Spread

• Bull Put Spread

• Bear Put Spread

Let's look at each of these in a little more detail.

1. Bull Call Spread

A Bull Call Spread refers to the buying of one call option at a lower strike price and selling another at a higher strike price. This is found to occur when a trader believes that the price of an underlying asset will likely rise but is not willing to pay the full cost as he or she sells a call option.

Structure

• Buy a call option. The strike price is lower

• Sell a call option. The strike price is higher

The risks are limited to the net premium paid. This is the cost of the bought option minus the premium received from the sold option.

The reward is also limited to the difference of the two strike prices, minus the net premium paid.

Example

Suppose the stock is trading at ₹ 100. You believe that the stock is going to run; however, you do not want to overpay. You can enter a bull call spread. In simpler words, A trader buys one call option at the strike price of ₹ 90 for ₹ 12 and sells another call option at the strike price of ₹ 110 for ₹ 5.

• Net Premium Paid: ₹ 12 - ₹ 5 = ₹ 7

• Maximum Loss: ₹7 (net premium paid)

• Maximum Gain: ₹20 (₹110 - ₹90) - ₹7 = ₹13

• Breakeven Point: ₹97 (lower strike price + net premium paid)

There, after the price of the stock exceeds ₹110, the maximum profit would be taken. On the other hand, below ₹90, the maximum loss for the trader would be the net premium paid.

2. Bear Call Spread

A Bear Call Spread is a bearish strategy in which a trader sells a call option at the lower strike price and buys another call option at the higher strike price. That is, it is used when the trader expects the price of the underlying asset to go down or nothing to happen.

Structure:

Sell a call option [lower strike price]

Buy a call option [higher strike price]

• Upside: Upside is capped at the difference of the strikes price minus the net premium received.

• Upside: Upside is capped at the net premium received.

Example:

Suppose again that the same stock traded for ₹100. You believe that the stock does not have a lot of price movement. So, you sell a ₹90 strike call for ₹12 and then you purchase another call for ₹5 by purchasing a ₹110 strike call.

Maximum Loss: ₹ 20 (₹ 110 - ₹ 90) - ₹ 7 = ₹ 13

Maximum Profit: ₹ 7 (top-most received)

Break-even: ₹ 97 (lower strike price + top-most received)

If the stock price does not exceed ₹ 90, maximum profit is attained. In case if the stock price exceeds ₹ 110, most likely loss can be obtained by subtracting the received premium from the difference between the strike prices.

3. Bull Put Spread

A bull put spread is a bullish strategy in which one put option is sold at a higher strike price and another put option is bought at a lower strike price. The bull spread is used when a trader believes that the price of the underlying asset may most likely go up or not down.

Structure

Sell a put option at a higher strike price

Buy a put option at a lower strike price

• Reward: Limited to the net premium received

• Risk: Limited to the difference between the strike prices, minus the net premium received

Example:

You think the stock would go up. You sell a put option at ₹110 strike price for ₹10 and buy another put option at ₹90 strike price for ₹4.

Net Premium Received = ₹10 – ₹4 = ₹6

• Maximum Loss: ₹20 (₹110 – ₹90) – ₹6 = ₹14

• Maximum Profit: ₹6 (net premium received)

• Break-even Point: ₹104 (higher strike price - net premium received)

The maximum profit will be realized, if at all, when the stock price stays above ₹110. Loss will be at maximum difference of strike prices minus premium, when the stock price falls below ₹90.

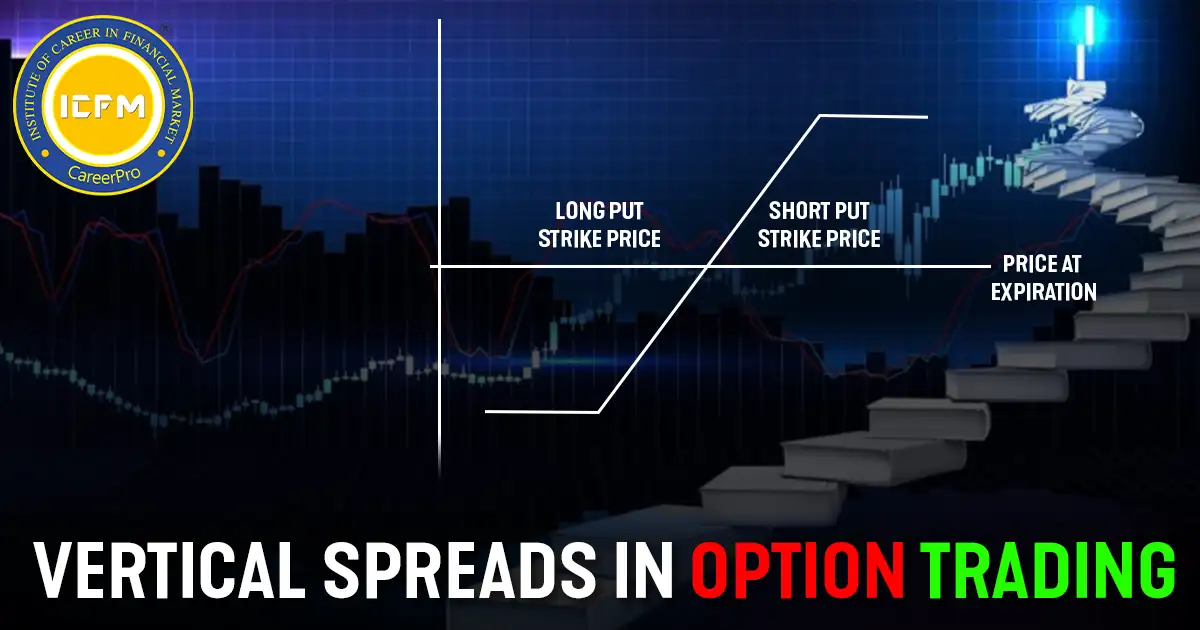

4. Bear Put Spread

Bullish Bear Put Spread: Buying a put with the higher strike price and selling another put with the lower strike price. It is used in a scenario where a trader believes that the underlying asset price will go down.

Structure:

Buy put option: Strike price of that put option is higher

Sell put option: Strike price of that put option is lower

• Risk: There is a cap on the potential return, which will be equal to the net premium paid, that is, cost of the option bought, net of the premium received on the option sold

•Reward: The amount to be returned will be capped at the difference between the two strike prices, minus the net premium paid.

Example:

If you think the stock price will decline, you can buy a put option at ₹100 for a net premium of ₹10 for ₹110, and sell a put option at ₹90 for ₹4.

•Net Premium Paid: ₹10 - ₹4 = ₹6

•Maximum Risk: ₹6 (net premium paid)

•Maximum Profit: ₹20 (₹110 - ₹90) - ₹6 = ₹14

•Breakeven Point: ₹104 (higher strike price - net premium paid)

The stock price moves down to a low of less than ₹90, thus realizing a maximum profit and, if it does not fall below ₹110, then the maximum loss is a net premium paid.

Key Benefits of Vertical Spreads

Risk Management: Both profits and losses are capped using vertical spreads, this trading approach is quite conservative.

Cost-Effective: The purchasing leg of the spread that is sold makes it cheaper, thus cheaper to implement.

Specific Gain/Loss: The risk is well managed as the amount that is exact is known that will be gained or lost before entering the trade.

Flexibility: Spreads can be used both in bull, bearish, or neutral markets.

Conclusion:

Vertical spreads are the major strategy in options for the traders because they define the nature of the risk-reward profile with elbow room to be able to extract maximum directional moves in markets. Whether it be of the bullish position-positioning of the market-place or a bearish one-vertical spreads form an agile and inexpensive way of managing risk while maximizing probable return. Understanding bull call spreads, bear call spreads, bull put spreads, and bear put spreads will be crucial for a trader to gain a better control of volatility in the market.