How to Read an Options Chain Like a Pro: Decode OI, IV, Greeks, Volume, and Strategy

Unleashing Your Options Chain Reading Skills

Options Chain Explanation

An options chain is a stock market tool which involves a table or spreadsheet showing all available call and put option contracts for a particular stock as Reliance or HDFC Bank and for an index like NIFTY 50 and BANK NIFTY on NSE.

An options chain also includes important information like:

-Strike Prices

-Premiums

-Open Interest (OI)

-Volume

-Greeks, some platforms

-Expiry Dates

-Implied Volatility (IV)

Step-By-Step Instructions

Picking the Suitable Trading Platform

Options chains can be viewed on:

- NSE India Website

- Kite (Zerodha)

- Upstox

- Angel One

- Sensibull which links with many brokers

Tip: For raw data, refer to NSE's website. For strategizing and visualisation, Sensibull is top tier.

Selecting The Underlying Asset

Here is a more narrowed down asset selection:

Stocks: Reliance, TCS and HDFC Bank

Indices: NIFTY 50, BANK NIFTY and FINNIFTY

NIFTY and BANK NIFTY is the best for options trading liquidity.

Get Acquainted With The Layout

An options chain is divided as follows:

CALL OPTIONS

STRIKING PRICE DONE BY A PUT OPTIONS

CALL

Bid / Ask

1718

Asking Price

Open Interest per Change in OI

Bid

Volume Imp.

Open Interest

Price per Change in OI

Volume

Imp.

Emphasizing Important Columns

The middle column refers to Strike price which is the middle column in the chain layout.

In the context of NIFTY or a stock, to ascertain whether it is in the money (ITM) or out of the money (OTM), compare the strike price with current spot price.

Premium (LTP / Bid / Ask)

LTP: Last traded price, which is the most recent transaction’s price.

Bid/Ask: Buy/Sell price proposed by traders.

A narrow Bid-Ask spread is advantageous.

Open Interest (OI)

Total positions which remain open in the particular strike.

Use change in OI to measure sentiment:

For calls OI increasing = resistance being formed.

Puts OI increasing = support being formed.

Volatility implicit

Expectation concerning the extensiveness of the movement in a security’s price.

High IV can lead to an increase in cost while low IV is advantageous to buyers.

5. Determine In the money vs out of the money

Example: NIFTY Spot = 18100

Call Options:

Strike Price of Call Options ITM when Strike < 18100

OTM when Strike > 18100

Put options

OTM when Strike < 18100

ITM when Strike > 18100

ATM means the strike price which is the closest to the current market price.

6. Interpretation of open interest reason for market sentiment

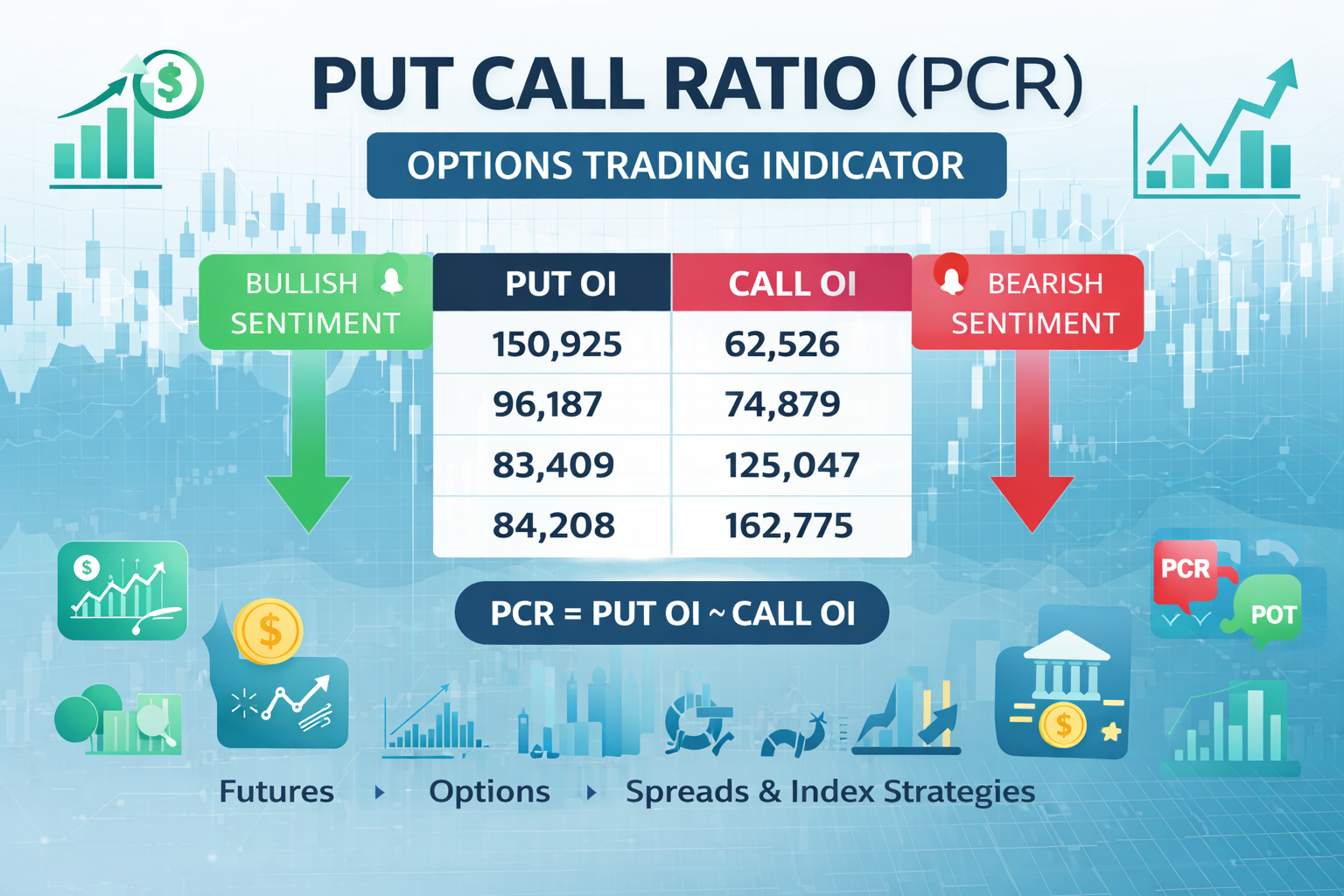

Utilize PCR (Put Call Ratio):

PCR equals total put OI divided by total Call OI

PCR greater than 1 gives bias towards bullish strategy.

PCR lesser than 1 gives bias towards bearish strategy

Some also look at Change OI + Price to identify bullish/bearish buildup.

7. Greeks (On Sensibull or Advanced Tools) As to NSE not showing Greeks, Sensibull and Opstra do provide them:

Greek Meaning Delta Sensitivity to underlying price Theta Time decay (Daily loss in value) Vega Sensitivity to changes in IV Gamma Rate of Delta change Example Breakdown (NIFTY 50) Suppose: NIFTY Spot = 18,000 You view NIFTY 18000 CE and PE CE Premium = ₹150, OI = 1.2 lakh PE Premium = ₹130, OI = 1.5 lakh Explanation: Higher Put OI at 18000 = Strong support. Some resistance = Moderate CE volume. Bullish buildup = PE OI is rising + price is moving up.

Final Pro Tips Liquid strikes only (50 points intervals for NIFTY). Weekly options for momentum trades; monthly for positional. Observe OI changes around expiry – they give a clue about expiry range. Utilize tools such as Sensibull, Opstra or Quantsapp for planning strategies.

Comments