Why Young Investors Should Think Small to Grow Big

If you are looking to invest your money as a young investor, think of small and mid-sized companies as they seem to have much potential. Companies of this size have a reasonable chance of generating profit. In fact, with the right strategies, small to mid companies can provide clever investors massive returns and increased profits.

1. High Growth Potential:

Small and mid-sized firms have usually completed their market research and now are in their growth phase—manufacturing goods and setting up in other regions. Unlike the established firms who face stunted growth, these companies have ample headroom for expansion.

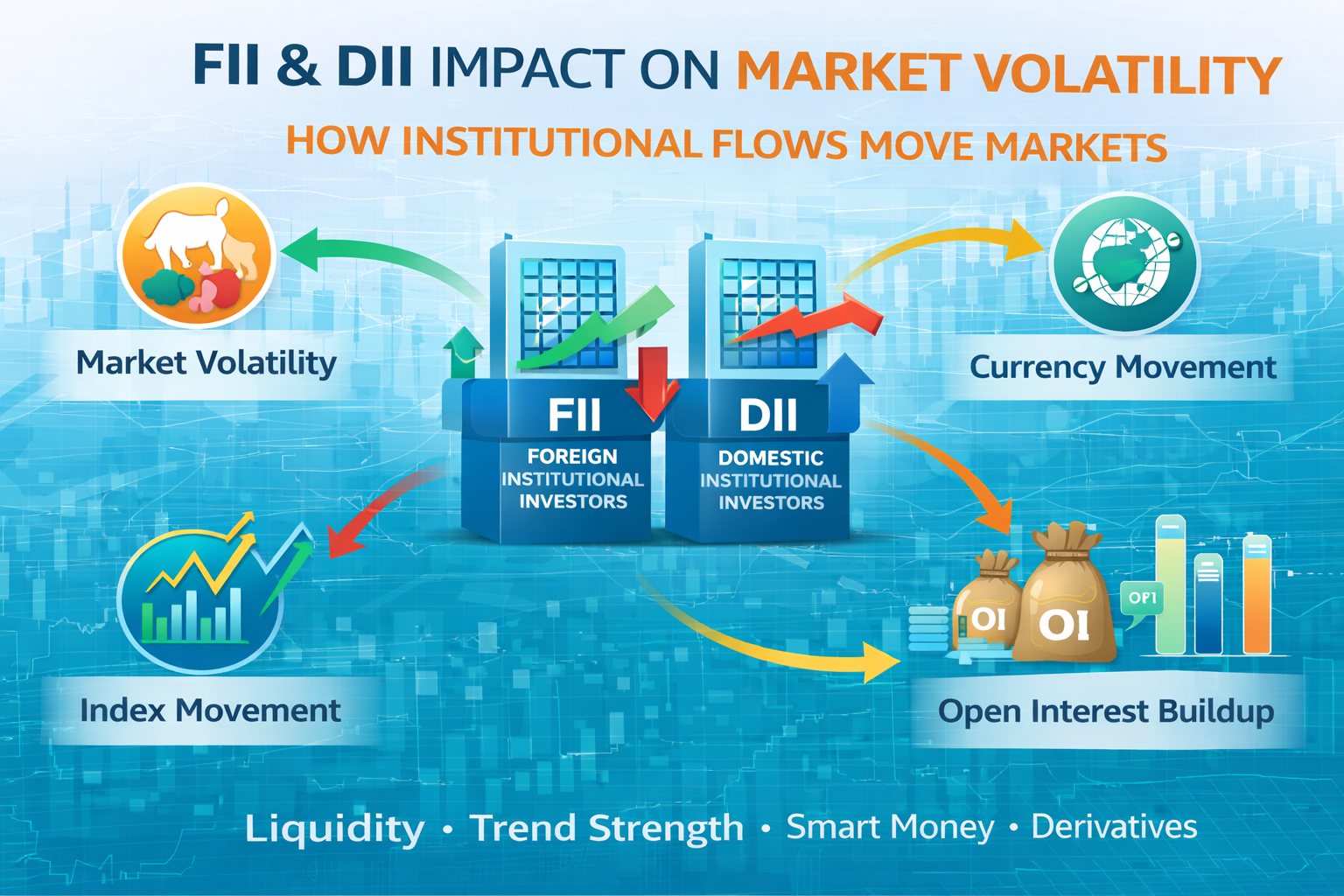

2. Stock Market Volatility Now Word Useful:

Frequently moving stock prices are not as bad as they sound as a young investor. The best thing about stock volatility is the ability to sit through both bad and good economic times. If you are ready to wait, moving prices will not be a disadvantage as returns will always be on the way.

3. Increased Knowledge:

Smaller companies equate to increased research. Apart from the balance sheet, you learn everything from the constantly shifting market trends. Investing is very informative and unlike funds trusts, stock markets have a real impact.

4. Hidden Jewels:

To fast-rising companies, such stocks are unknown and do not catch the eye of huge investors and even higher analyst. This gives them time and space to operate without worrying about rent and allowing retail investors get the profits before it is too late.

5. Risk tolerance aligns with the strategy:

As a young investor, taking strategic risks may yield positive outcomes. Small-to-mid cap stocks are more volatile than large cap stocks but with strategic patient diversification, can provide significant long-term returns.

6. Real life examples:

Bajaj Finance, Relaxo, and Deepak Nitrite were once and obscure mid-cap names. Investors who boldly adopted them early on have seen returns ranging from ten-fold to fifty-fold.

Bottom line:

Younger investors are probably being too conservative if they're only focusing on large brands. A well-compiled portfolio of researched small-mid cap stocks could help unlock massive wealth over 10-20 years. Start small, stay consistent, and give it time.