Market volatility drives derivatives pricing, impacting options, futures, and swaps. Understanding it helps traders manage risk and develop profitable strategies.

Market volatility drives derivatives pricing, impacting options, futures, and swaps. Understanding it helps traders manage risk and develop profitable strategies.

Risk management is crucial in derivative trading to control exposure, protect capital, and ensure long-term sustainability. Here's how to manage ....

Volatility trading focuses on price variations rather than direction, with options offering profit potential. Key issues include strategies and risk ....

In the derivatives and options trading world, two of the most crucial indicators are Long Build-up and Short Build-up. These ....

A call option is a financial derivative whereby the buyer of such an option has the right but is not ....

The butterfly spread is quite a popular options trading strategy among the various options trading methods used by the traders ....

Leverage is a financial strategy that enables investors to control a larger position than their initial capital would allow, often ....

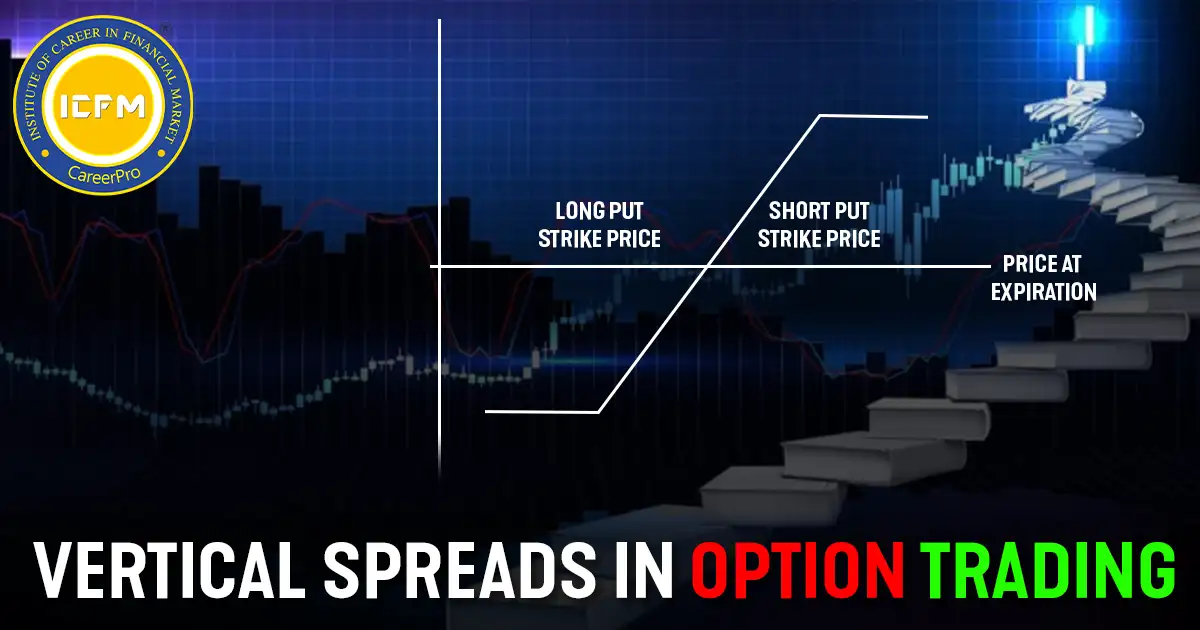

Vertical spreads involve buying and selling two options of the same type with the same expiration but different strike prices, ....

In India, margins are deposits traders must keep to cover potential losses in futures and options, regulated by SEBI and ....

In derivatives, a "spread" involves taking multiple positions to reduce risk or maximize profit, offering benefits like risk limitation and ....