The stock market can often be a confusing place, especially with so many things affecting how much stocks and options ....

The stock market can often be a confusing place, especially with so many things affecting how much stocks and options ....

Leverage is a financial strategy that enables investors to control a larger position than their initial capital would allow, often ....

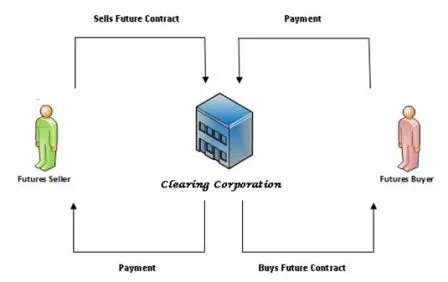

Finance contracts are usual for which an asset can be sold or purchased at a future date. There are two ....

The stock market has its arsenal of tools that help traders make an informed guess as to how other people ....

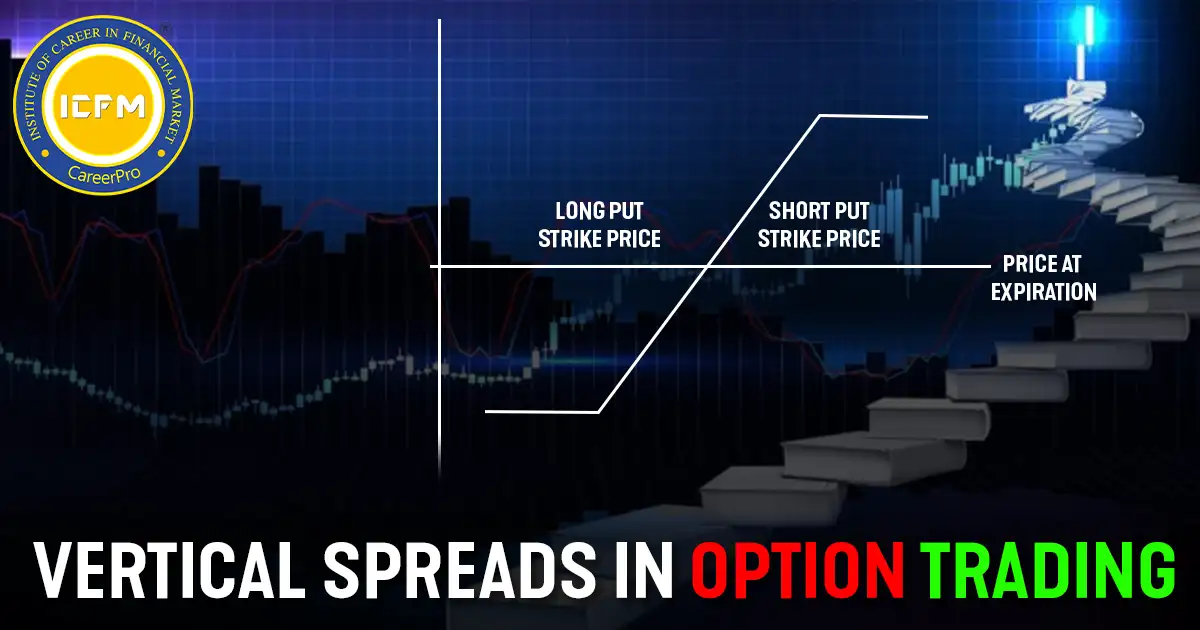

Vertical spreads involve buying and selling two options of the same type with the same expiration but different strike prices, ....

In India, margins are deposits traders must keep to cover potential losses in futures and options, regulated by SEBI and ....

Margin requirements in derivatives trading are some of the important controls and ways to ensure that parties to trading are ....

In derivatives, a "spread" involves taking multiple positions to reduce risk or maximize profit, offering benefits like risk limitation and ....

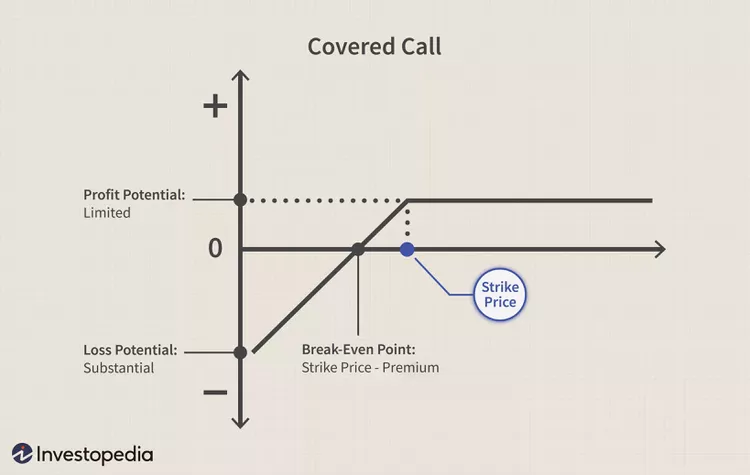

Option selling involves collecting premiums from buyers but carries high risk, as potential losses depend on the underlying asset's movement.

The Pricing of futures contracts revolves around the relationship between the futures price and the spot price of the underlying ....