Introduction

Indian stock market in 2025 is now more responsive to global happenings than it has ever been. Due to ever-increasing pace of globalization, changes in economic superpower countries, and increasing geopolitical tension, the domestic markets are reacting contemporaneously to international events. It is currently vital to fathom how these forces impact stock performance, sectoral movements, and investor actions to make investment decisions in India today.

This resource document outlines the major global phenomena that significantly control the Indian stock exchanges and analyzes how they can storm these turbulent waters.

1. Indian Equity Market Responding to Growing Economies

The West’s inflationary pressures, restricted monetary policy in developed countries, and restrained consumer spending in key markets have been parts of factors shaping the 2025 global economic slowdown. These trends are also augmentation for slow GDP growth in US, UK, and Germany which in turns impacted India’s export-driven industries like IT services, pharmaceuticals, and textiles.

With the contraction of global demand, Indian exporters appear to be witnessing declines in revenue which in turn is impacting the stock prices of companies operating in industries exposed to the international markets. Operating multinationals in India seem to suffer from lower than forecast revenue which in turn has eroded investor sentiment and heightened volatility around benchmark indices such as Nifty 50 and Sensex.

Additionally, the inflationary Outlook of the US and EU has forced the Fed and the European Central Bank (ECB) to aggressively hike interest rates, changing the economics of capital allocation and impacting the concentrated investments (foreign institutional investments) in India.

2. Geopolitical Conflict and Investors are Risk Tolerance

Ongoing geopolitical challenges such as the Russia-Ukraine war, Middle East disputes, and China-Taiwan headwinds have constrained the global supply chain and created energy insecurity everywhere. India is mostly dependent on crude oil imports and is susceptible to energy price shocks resulting from international disruptions.

Also, In an important development, a surprise Ukrainian offensive on Russian military assets was witnessed in June 2025, drastically escalating the conflict. The new military development has rattled the global markets which has resulted in an immediate spike in crude oil prices and decrease in global investor confidence. Indian equities particularly in oil sensitive sectors such as aviation, logistics, and chemicals have responded with sharp corrections.

Adding to existing uncertainties is the lingering Israel-Palestine conflict along with the renewed cyber warfare threats from North Korea. These tensions generate spikes in volatility indices, instilling fear in domestic and foreign markets alike. These conditions often result in emerging markets experiencing capital flight, leading to decreased equity valuations and heightened volatility.

Indian commodity markets tracking defense spending, energy infrastructure, and other related activities are most sensitive to these changes. Sectors that depend on the stability of international markets such as aviation, automobiles, and consumer durables tend to sharply bounce back whenever global risk surges.

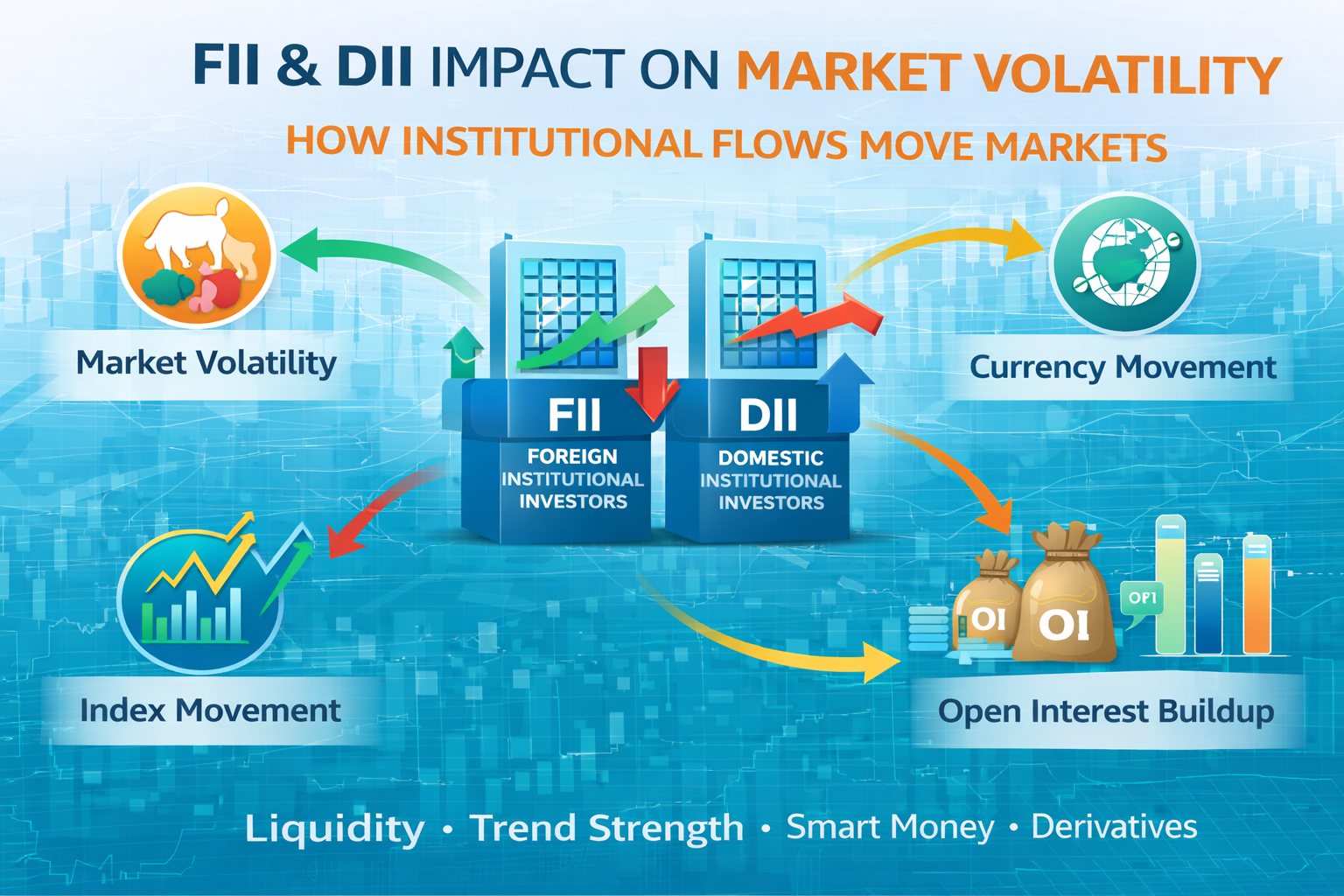

3. US Federal Reserve Decisions and Impact on FIIs

The statements from the US Federal Reserve are closely scrutinized by Indian investors due to how they affect global market liquidity. The Fed set a hawkish course at the beginning of 2025, planning a cycle of interest rate increases to combat enduring inflation.

Rising interest rates from the US lead to increased investment in US treasury securities. This causes capital outflow from investing hubs such as India. These capital flights cause diminished liquidity to the Indian markets, which puts downward pressure on market valuations, especially in infrastructure, real estate, and banking, which are heavily reliant on capital.

These movements of capital tend to have an adverse effect on the Indian rupee as it often depreciates. This exacerbates inflation, weakens enduring profits, especially for those companies that depend on imported raw materials due to their high foreign debt, and increases costs associated with imports.

4. Trade Policy Changes in China and Competition within the Region

Changes to self-reliance trade policies that concentrate on expenditure within the economy and bolster supply chain integration have created a new trading paradigm within the Asia-Pacific region. There has been a direct impact on the evolution of trade dynamics due to China deliberately increasing domestic consumption and lowering their dependency on western economies.

This has reduced demand from China for goods produced by other countries like India, which adversely impacts other economical like Indian sectors such as chemicals, electronics, and engineering goods. There has also been a greater shift towards open competition for global market share, particularly in low-cost manufacturing and technology services.

In a bid to strengthen the dependence of trade on the country, India has faced with a focused Make in India and bolstered PLI schemes towards encouraging manufacturing. This has invited foreign funding in some industries like those dealing with semiconductors, renewable energy, and auto components, which offsets some of the reduction in Chinese demand.

5. Surge in Global Commodity Prices and Inflation

In 2025, the global markets for oil, natural gas, copper, and aluminium, as well as other food grades, saw tremendous volatility due to factors like droughts, sanctions on key producers, and supply chain disruptions.

Like many of its peers, India has simultaneously contended with inflationary pressures and soaring input costs straining most of the economic sectors. The tumultuous margins contracted and weakened the profitability of the automotive, cement, steel, and FMCG sectors—thereby negatively impacting the stock market.

In order to curb inflation, the Reserve Bank of India (RBI) has set the repo rate higher than before to regulate liquidity. Although this balance prices, higher business costs lead to subdued capital expenditure and lower funds towards investment for expansion.

6. Global Tech Trends and Indian Market Adaptation

The most advanced and emerging technologies, such as AI, blockchain, IoT, and cloud computing, are transforming business at an unparalleled rate. Digitalisation is being adopted on an unprecedented level across Indian enterprises, driving a fundamental shift in the country’s market.

The BFSI sector, Edtech, Healthtech and E-commerce companies are leading this charge and receiving investor focus because of their innovativeness and prospective growth. Although regulatory and profitability hurdles exist, opportunities are emerging due to the creation of new fintech startups.

Investors are increasingly favoring stock’s valuation for companies with a considerable digital visibility while older players who are slow with tech adoption suffer with eroding value. The shift towards digital transformation metrics is changing the investment framework for evaluating risk, growth, deep-value, and longevity potential.

7. Climate Change + ESG Undertakings + Sustainable Capital

Internationally, climate change is emerging as a focal point in investment strategies. There has been a visible shift regards investing as institutional investors are expecting ESG compliance while allocating capital. This appears to be gaining traction in India as well.

There is rising interest for companies in renewable energy, electric vehicles, green infrastructure, and sustainable agriculture. There is pressure on coal and thermal power or chemical intensive businesses to change or lose the confidence of investors.

Other Indian regulators like SEBI are sharpening disclosure compliance standards, adding an ESG governance layer. For the Indian stock market, this is resulting in a clear revaluation of businesses relative to their sustainability score rather than merely their earnings.

8. Issues on Volatility of the Exchange Rates and the Trade Balance

Currency Blockchain Markets show greater values of currencies of Fed-sustained nations over comparatively weaker, lesser developed nations: dollars strongly stand while emerging currencies fluctuate during the year of 2025. India finds itself handling a plethora of issues considering the capital outflows of the country and the expanding trade deficits: currency markets hold struggling sentiments over the rupee.

The slowly deflating rupee poses itself as greater challenge to sectors dependent on the downside including chemical and renewable industries. The suffering currency is beneficial for exporters and comes as blessing to IT services, textiles and Pharma industries.

Investors find themselves standing both on the mitigation end of these changes and on the downside of currency fluctuations. Active companies dealing with forex tend to manage their hedging strategies optimally.

Stock value adjustments always appear to be with these modifications; sensitive to currency fluctuations exhibit the largest volatility and receive the heaviest impact.

9. Strategic Positioning and International Trade Deals

Active association from Indian counterpart in regional economic setups perceives new priorities which form a basis for the India–EU Free Trade Agreement, Comprehensive Economic Partnership Agreement (CEPA) with the UAE and facilitates further participation in ASEAN.

They help the emerging industries in supporting slabs like Engineering and Electronics by going further in removing tariffs or easing custom restrictions along with unified regulation. But the clauses which bound increasing procedures for non-green compliance alongside labour force contract mean that greater control emerges compromising softer green terms of the simple agreements increases hearing sign contrarian silencing to sustainable contracts.

Wells Fargo believes that compliance and legal-friendly companies are commanding new attention from the capital market. These agreements are developing growth opportunities while further diversifying risks.

10. Investor Behavior in an Integrated Economy

Investment is more systematic in an integrated economy because information is readily available across the globe through news, direct access, and sophisticated tools for analysis. There is notable information asymmetry as of 2025, with a massive disparity bordering on a single command for Indian retail and institutional investors—the estranged dependence on NPC on Wall Street moves and ECB policy whispers.

We are witnessing an increase in algorithmic trading and AI portfolio management, as well as thematic investing. There is also a shift in focus for Indian investors, who are moving in droves from domestic equities to get interested in international mutual funds, overseas ETFs, and multi-asset funds.

Information access is bettering the efficiency of the Indian market, but is also increasing vulnerability to global market sentiment. In order to navigate hurdles, one requires a deep understanding of macroeconomics, geopolitics, and international finance.

Final Thoughts: The Indian market in 2025 serves as an example of a world where no single market operates independently. Monetary controls for other economies, intrastatal geopolitical strife, mergers and acquisitions, and eco-political policies are scrutinizing stock purchases and value assessments.

In the current context, the Indian stock market has to face fundamental restrictions.

These are some of the many guidelines investors need to follow if they want successful trade results. Investors need to notice every single big or small trend in the Indian economy.

The understanding and execution of Indian trade strategies need to be stepped up widely and understood on an international level. This makes it essential to expand your awareness if you are at a policy making level in India.