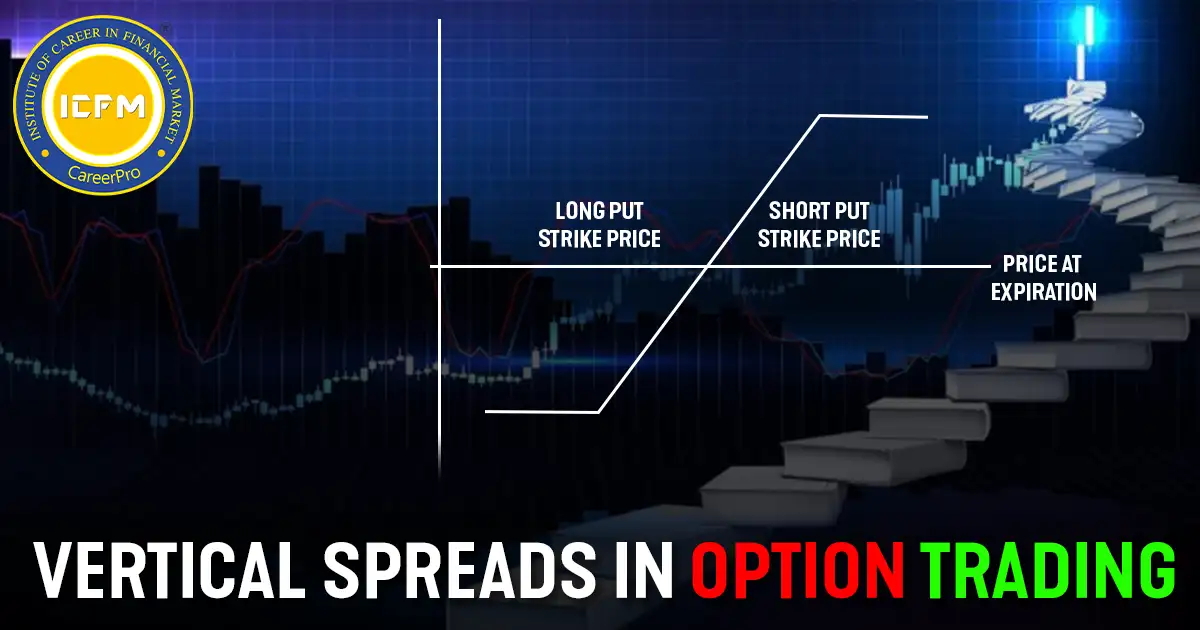

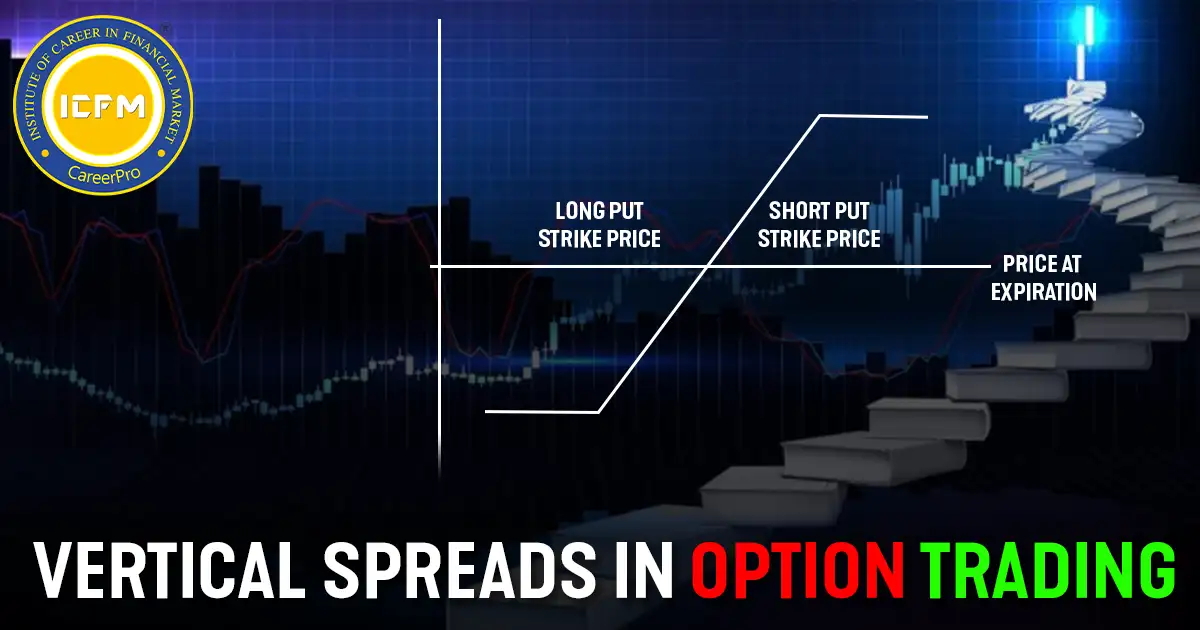

Vertical spreads involve buying and selling two options of the same type with the same expiration but different strike prices, ....

Vertical spreads involve buying and selling two options of the same type with the same expiration but different strike prices, ....

In India, margins are deposits traders must keep to cover potential losses in futures and options, regulated by SEBI and ....

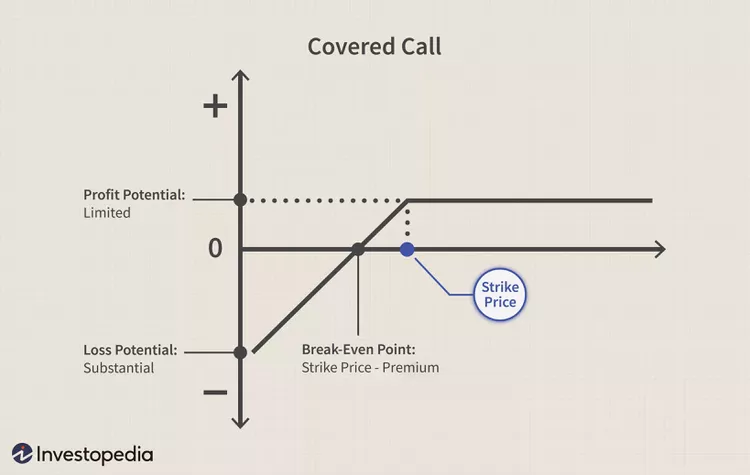

In derivatives, a "spread" involves taking multiple positions to reduce risk or maximize profit, offering benefits like risk limitation and ....

Option selling involves collecting premiums from buyers but carries high risk, as potential losses depend on the underlying asset's movement.

F&O contracts form an essential part of the derivatives market in India, and a deep understanding of the nuances involved ....

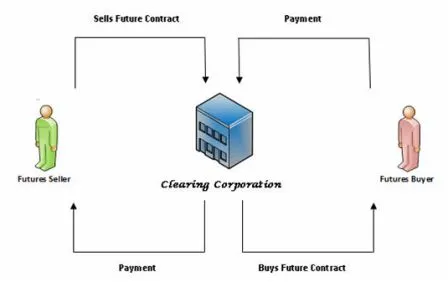

A futures contract is a standardized contract between two parties to buy or sell an underlying asset such as a ....